Smartsheet platform Learn how the Smartsheet platform for dynamic work offers a robust set of capabilities to empower everyone to manage projects, automate workflows, and rapidly build solutions at scale.Additional resources for managing your practice finances will appear in future issues of the PracticeUpdate E-Newsletter and on. Do you have more assets? Have you accrued more debt? Invested in equipment and facilities? Are your pressing financial obligations (current liabilities) under control? Is the amount that payers owe you growing? Calculating financial ratios and trends can help you identify potential financial problems that may not be obvious.ĭata from your balance sheet can also be combined with data from other financial statements for an even more in-depth understanding of your practice finances. With balance sheet data, you can evaluate factors such as your ability to meet financial obligations (current ratio, days cash on hand) and how effectively you use credit to finance your operations (debt ratio, debt to equity ratio).Īlthough the balance sheet represents a moment frozen in time, most balance sheets will also include data from the previous year (or even multiple years) to facilitate comparison and see how your practice is doing over time.Ĭompare the current reporting period with previous ones using a percent change analysis. Your balance sheet also provides some of the data you will need to calculate the basic financial ratios that can help you track the performance of your practice, identify trends and implement strategies to shore up your finances. If not, check your math or talk to your accountant. Remember -the left side of your balance sheet (assets) must equal the right side (liabilities + owners' equity). Total liabilities and owners' equity are totaled at the bottom of the right side of the balance sheet.

#Blank balance sheet helper plus#

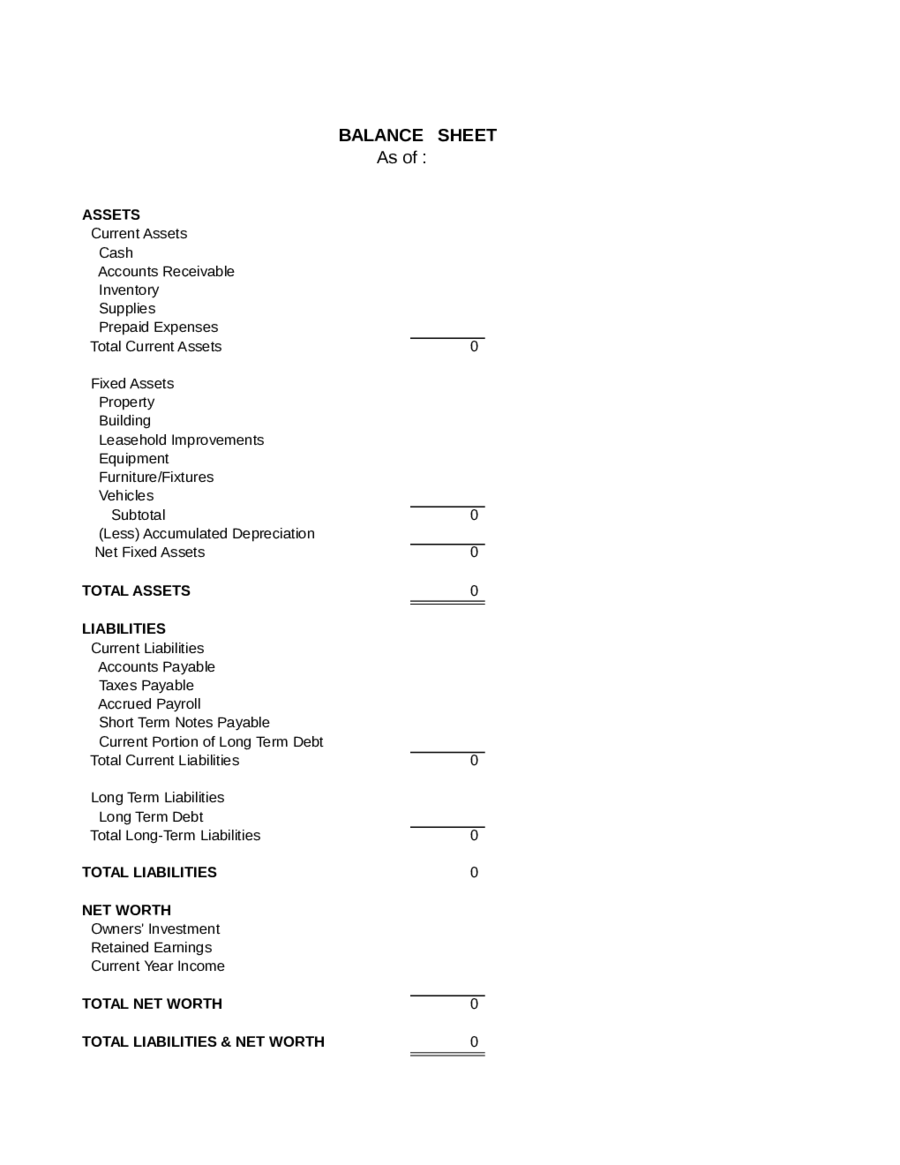

Owners' equity does not necessarily represent current market value and therefore should not replace a comprehensive valuation by an expert when considering buying or selling an existing practice.ĭepending upon the legal structure of your practice, owners' equity may be your own (sole proprietorship), collective ownership rights (partnership) or stockholder ownership plus the earnings retained by the practice to grow the business (corporation). Note: Valuing a practice can be extremely complex. In simplified terms, it is the money you would have left over if you sold your practice and all of its assets and paid off everything you owe. Owners' equity (sometimes called net assets or net worth) represents the assets that remain after deducting what you owe. Talk to your accountant or financial advisor to make the most appropriate decisions for your practice.įinally, total assets are tabulated at the bottom of the assets section of the balance sheet.

Note: Various ways to calculate depreciation can have different tax implications. The portion of equipment cost that is estimated to have been used up, based on the equipment's estimated useful life, may be subtracted from fixed assets in the form of accumulated depreciation to calculate net property and equipment.

Current assets, such as cash, accounts receivable and short-term investments, are listed first on the left-hand side and then totaled, followed by fixed assets, such as building and equipment. On a balance sheet, assets are listed in categories, based on how quickly they are expected to be turned into cash, sold or consumed. Assets also include intangibles of value, like patents or trademarks held. Your assets include concrete items such as cash, inventory and property and equipment owned, as well as marketable securities (investments), prepaid expenses and money owed to you (accounts receivable) from payers. Note: Some balance sheets do not use the left-right format and instead list assets on top, followed by liabilities and then equity.Īssets are the things your practice owns that have monetary value. In other words, the left and right sides of a balance sheet are always in balance. Consistent with the equation, the total dollar amount is always the same for each side. With assets listed on the left side and liabilities and equity detailed on the right. The layout of a balance sheet reflects the basic accounting equation: Although a balance sheet can coincide with any date, it is usually prepared at the end of a reporting period, such as a month, quarter or year.Ī sample balance sheet for the fictitious Springfield Psychological Services at Decemand 2003 is presented below, as an example. This financial statement details your assets, liabilities and equity, as of a particular date.

Your balance sheet (sometimes called a statement of financial position) provides a snapshot of your practice's financial status at a particular point in time.

0 kommentar(er)

0 kommentar(er)