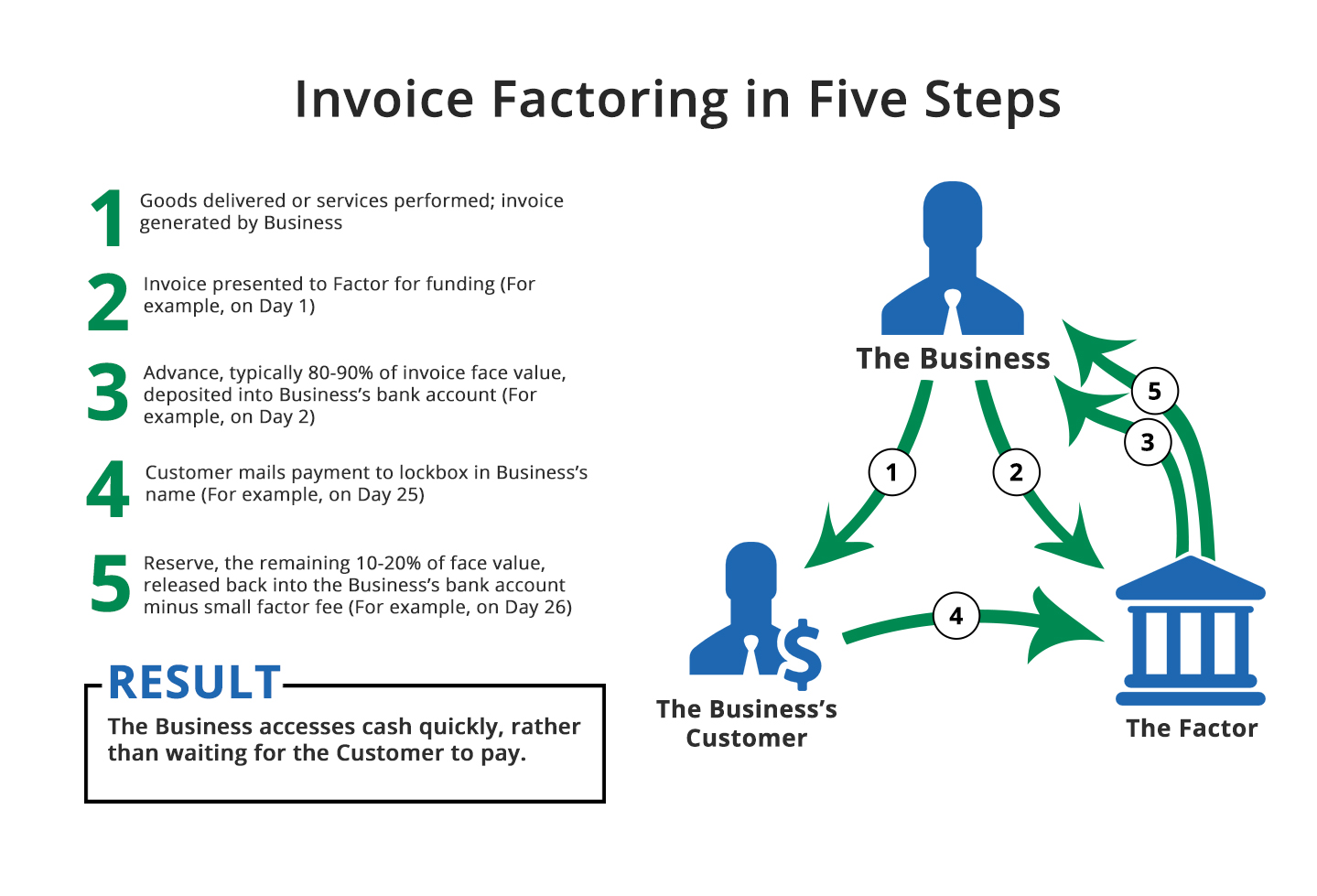

Invoice factoring cost: Invoice factoring is regarded as a high cost financing option. This could also take some time to research and delay or reduce your payment. Your provider will want to ensure that they can get paid on their invoices, so some of those invoices may not be accepted by the factoring company if they feel your customer has weak finances. If your provider uses heavy-handed collection methods, you may risk losing your client.Ĭustomer creditworthiness or questionable finances may disqualify some invoices: While your invoice factoring service may not check your credit, they will likely research your customer’s business credit. Keep in mind that you are still doing business with your customers. It is important to understand the collection practices of your provider to ensure it is done in a friendly and ethical manner. Loss of Control: Since you transfer ownership of the invoices to an invoice factoring service, you also give-up the right to collect from your own customers. However, there are some downsides and risks associated with this type of financing. So far we have focused on the positive aspects of invoice factoring. In this case 80% of $95,000 would be the amount of the advance paid upfront or $76,000 ($95,000 x 80% = $76,000) with the remainder of $19,000 paid to the small business after the invoices have been paid in full. Invoice factoring companies may wish to pay 80% of the invoice value less the factoring fee. Typically, the factoring company will make an upfront payment of the invoice value less a holdback amount in case invoice amounts are not paid by customers. The factoring company charges a “factoring fee” of 5% of the value of your invoices so they charge $5,000 and agree to buy the invoices for $95,000 ($100,000 minus $5,000 factor fee). You need immediate cash so you contact an invoice factoring company and they agree to purchase your unpaid invoices. That means your business has $100,000 in unpaid invoices or what is referred to as invoice value. For hypothetical purposes we’ll assume that each invoice is for $1,000. Let’s say that you have 100 invoices that are active and due in 30 days.

Technically, invoice factoring is not considered a loan because the business owner is not required to make any payments after they sell their invoices. It’s is a financing arrangement for small businesses that involves selling unpaid invoices or outstanding invoices (or in some cases their accounts receivables) to a third party (invoice factoring company) in exchange for a lump sum of cash. Invoice factoring is not a business loan.

0 kommentar(er)

0 kommentar(er)